Monthly Main Meeting Highlights

The January 2019 Main Meeting

Welcome to 2019, we hope you all had a great break.

Tonight, our 2019 meetings got off to a great start with EFTPOS calling by

but first up our President Alex

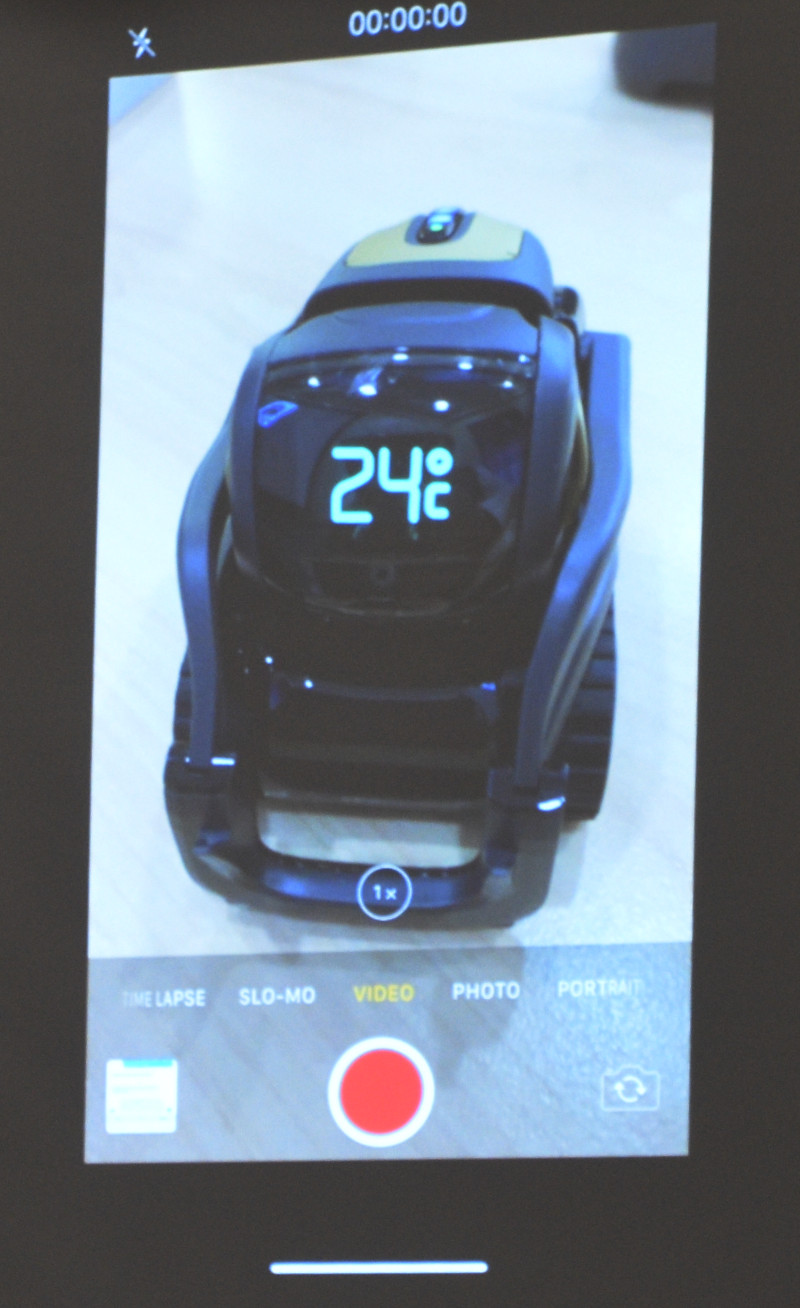

started the night with lots of Techno news, and showed us this great new robot, Vector by Anki. https://www.anki.com/en-us/vector

He’s a cute critter. He can play with his cube, talk to you and can use Alexa, the voice assistant developed by Amazon, to answer your questions, like, “Hey Vector what’s the temperature?” which it displays on its face.

He runs on an app using IOS or android

He has eyes and sensors so when he goes exploring, he won’t fall of the table.

To keep him happy he has a cube to play with

and you can stroke him like a cat.

Watch out he’s good at cards.

Then when he’s tired, he finds his charger and docks to recharge.

And when he’s tired, he goes to bed.

We also had a look at a great YouTube introduction.

After the break, our 2019 meetings got off to a great start with EFTPOS calling by.

EFTPOS stands for Electronic Fund Transfer Point of Sale.

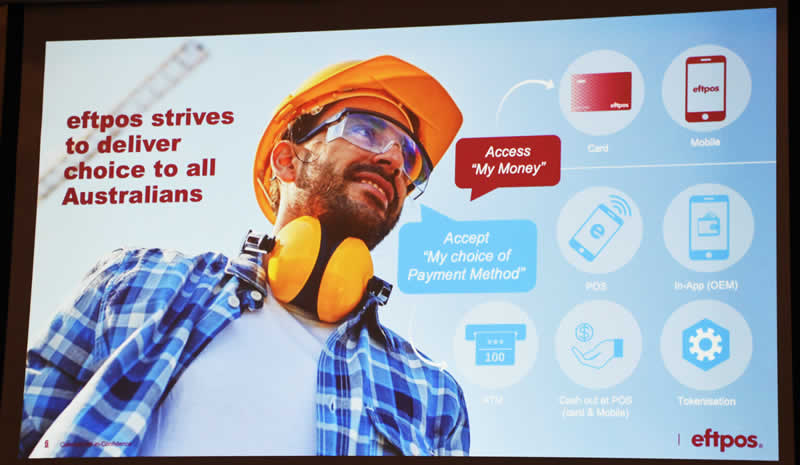

EFTPOS was founded by a coalition of around 20 companies, both Banks and financial companies. It’s a not for profit company with no shareholders and it pays no dividends, and recently PayPal came on board. Warwick Ponder, Head of Corporate Affairs at EFTPOS, was on hand to give us the run down on this Australian invention and Australian company. Warwick pointed out it was one of the first times the major banks had voluntarily co-operative without the Reserve Bank driving the idea.

These days it’s all about payments and now Australians are using cards to make upwards of 2.5 billion cashless payments. Apparently, Australia has an average of 2 cards per person. All these cashless transactions were based around two companies Visa and Mastercard and they charged fees.

So in April 1984 EFTPOS made its first transaction between a major bank and a supermarket in Neutral Bay. The system was rolled out over the next 8 to 9 years and now hosts proprietary cards, multinetwork debit and credit cards, and even the new prepaid gift card, with around 800 thousand merchants in the system. This appears to be heading us down the road to a cashless society. Visa reported that last year 94% of their cards were now contact payments or “tap and go”.

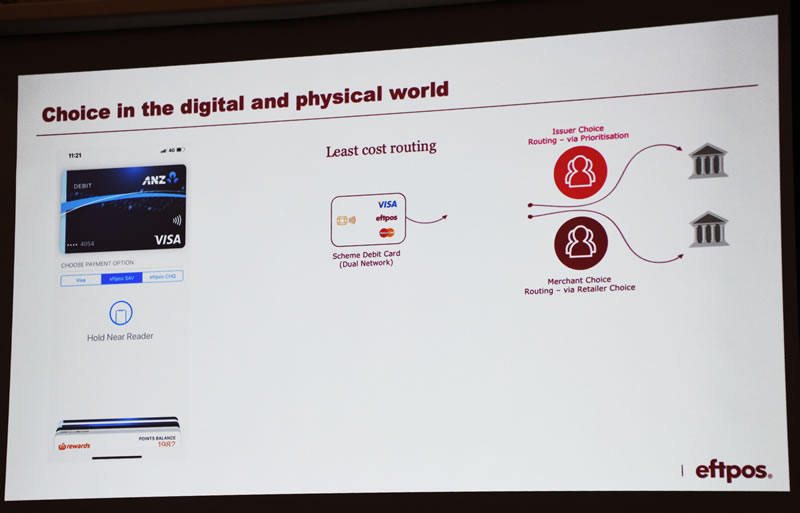

Now with EFTPOS we have real competition to help keep prices down. They have created their own chip sets and have around 10 million of those. They also have proprietary network cards for Visa and MasterCard with the credit chip on the front and EFTPOS on the back. Now, thanks to regulation the chips on those cards no longer have to go through the credit card network. That means merchants can now choose the route their transactions through EFTPOS rather than pay more to use the credit card network. Warwick mentioned that, according to the Reserve Bank, was about 50 % cheaper than the credit networks.

Continuing with the chip set, the international credit network originally only allowed for one application on the chip. Now the new EFTPOS chip set allows for as many applications as the card issuer wants. It’s up to the bank or credit union to unlock that functionally on the cards they issue and it’s up to the merchant to choose which system to use.

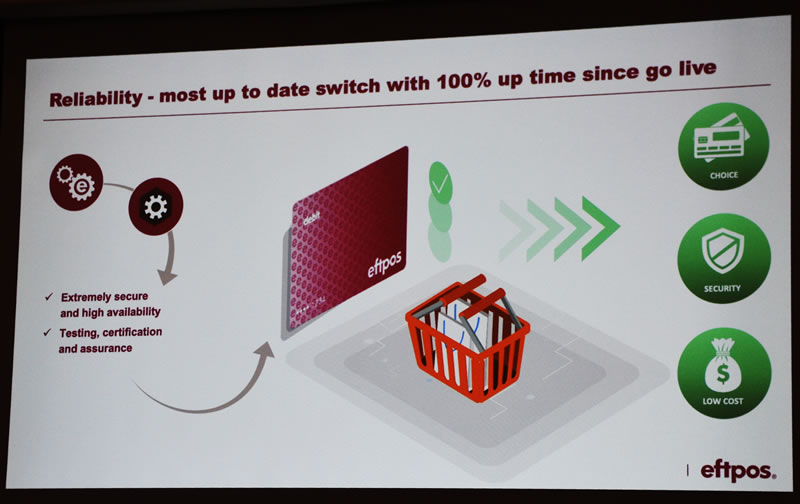

Before EFTPOS each credit company, bank, or the major retailer, had its own network. Now, EFTPOS has its own hub which eliminated the need for each financial group to have their own network. Any changes can be rolled out across all the groups simultaneously. From day one it’s never had an outage. Most ATMs now go through the EFTPOS hub which has allowed a significant drop in fees.

What that means now is EFTPOS is ready for the online environment. With the new technology EFTPOS has been able to enter the mobile payment systems. Apps like Beem It, along with Apple and Google pay, and most of the apps from the major banks, allow electronic fund transfer.

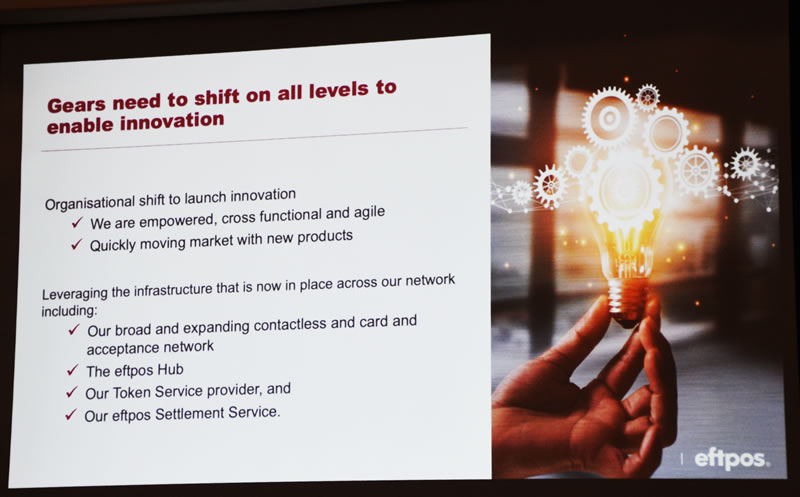

EFTPOS has a new CEO, Steve Denton, and a new approach to development. He introduced the “agile concept” to help development of new technologies. At EFTPOS this approach sets goals using close time lines like every two weeks rather than “We will build this app”. The tasks are broken down and handled across departments

To show how effective the approach was, last Friday they introduced multi network functionally to the Apple Pay app, the first in the world to do so. ”Now you can load (say) a visa card on to the Apple Pay”. So then you, the customer, can make the decision as to how you make the payment, you can even get cash out using your phone. With these new multi-function cards you can determine the default payment method.

ANZ is the first bank to introduce this customer choice on their app but others will soon follow.

The security of this method is in the tokenising system EFTPOS uses. You could load your visa card on your card, your phone, and you’re banking app. In effect each instance of your card will have a different security token. So if you lose your phone the other places where your visa was uploaded are safe.

The security of this method is in the tokenising system EFTPOS uses. You could load your visa card on your card, your phone, and you’re banking app. In effect each instance of your card will have a different security token. So if you lose your phone the other places where your visa was uploaded are safe.

The Raffle

We had a set of great raffle prizes from EFTPOS and some other great prizes

and here are some of our winners.